President | ChurchWest

In ministry, accurately classifying employees is more than procedural— it’s about valuing the roles everyone plays in ministry. In this article, we’ll explain how to classify church and ministry workers as exempt, non-exempt, or independent contractors and get you on the road to compliance.

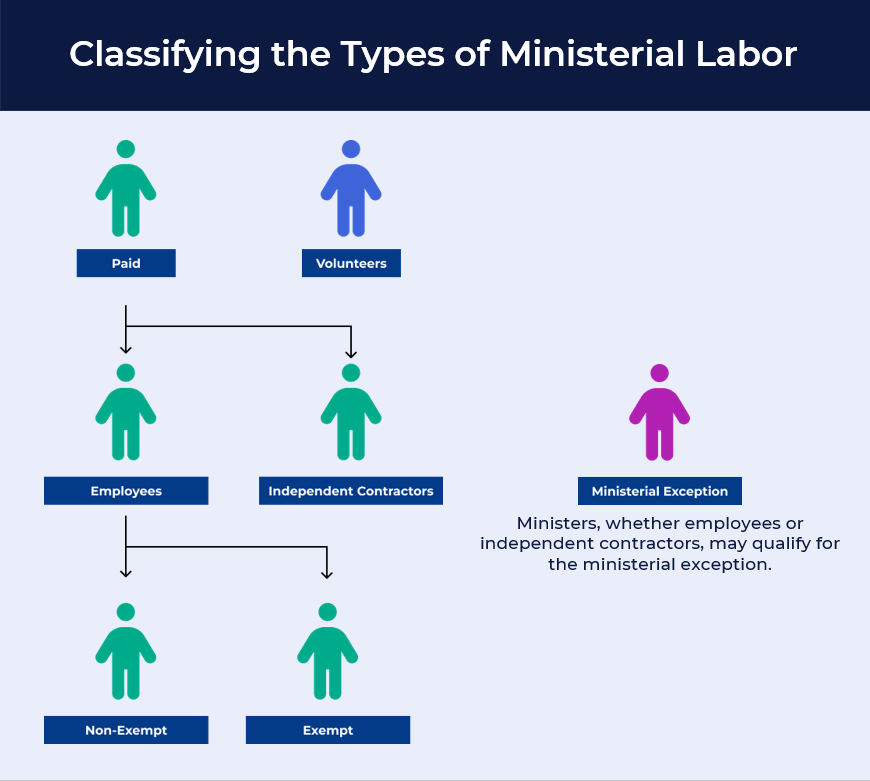

Let’s start by categorizing who works in ministry to begin with.

Volunteers offer their time and talents without receiving compensation. Because there is no employer/employee relationship, volunteers don’t enjoy the same protections as paid workers.

If volunteers are paid, then they are not volunteers. Be very careful when offering financial compensation to those serving your ministry on a volunteer basis. Paying these individuals can risk creating an Employer / Employee relationship in the eyes of the law, including the rights and protections that brings.

Most employees in ministry are non-exempt. These employees are eligible for overtime pay and minimum wage protection, requiring the accurate tracking of hours worked. These employees are not exempt from overtime pay under the Fair Labor Standards Act.

Exempt Employees are paid workers who typically hold positions that are managerial, professional, or administrative in nature. These roles are salaried and are exempt from overtime pay under the Fair Labor Standards Act (FLSA) due to their duties and salary level.

To classify an employee as ‘exempt’, they must meet the following tests:

Hours test: The worker’s schedule is based on 2080 hours of work annually (There is no such thing as Part-time Exempt)

Compensation Test: The worker earns at least twice minimum wage for full-time work (40 hours x 52 weeks = 2,080 hours per year)

Duties Test: The worker holds a position that is managerial, professional, or administrative in nature.

For an depth explanation of Exemption Duties Tests, watch our webinar on The ABC’s of Classifying Employees.

Independent Contractors are not employees of your ministry. Because their work is independent of an employment relationship with your organization, they are not covered by the same labor laws regarding pay, benefits, and employee protections.

Basically, these individuals tend to own and operate their own business, or are employed by a 3rd party entity.

In California, we recommend the FOE Test to determine whether a worker qualifies as an independent contractor. Let’s break it down:

Free of Control (F): Independent contractors operate with significant independence. They control how their work is performed, without your ministry dictating the process or methods for achieving the work results.

Outside the usual course of business (O): The work performed by the independent contractor must be outside your ministry’s core operations.

Established Trade or Business (E): Independent contractors typically offer their services to the public at large, not just to a single ministry. They have their own business, which should include having a business license, their own insurance and they may need to provide benefits to their own employees.

For an in-depth explanation of Independent Contractors, check out our Ultimate Guide to Independent Contractors and our sample Independent Contractor Agreement Form.

Ministers occupy a unique, some may say weird, carve out in U.S. employment law. This is because ministers may fall under a category known as the “ministerial exception”. This legal doctrine recognizes the special, constitutionally protected relationship between a ministry and its ministerial staff.

For a full breakdown of the ministerial exception, please watch our co-hosted webinar with BQB Law and Church HR Network.

Under the Ministerial Exception, certain laws, such as anti-discrimination laws and wage and hour regulations, may not apply to ministers or other employees who perform religious functions. This means that religious organizations have different legal obligations towards ministers than towards non-ministerial employees. This fact has huge impact on compliance with labor law.

Unfortunately, there is no black & white formula for figuring out which employees can be classified as ministers under the ministerial exception. The courts may examine a wide variety of factors, and weigh all the information at hand when determining who meets the definition of a ‘minister’.

Subscribers to HR 360 by Church HR Network receive 1-1 guidance on this topic, as well as a checklist for determining which employees meet the legal definition of a minister.

Go to churchhrnetwork.com to learn more about how a faith-based HR strategy can change you lead your team.

Universally, insurance covers damages, typically not Wage & Hour claims. Misclassification claims are one of the most common types of wage & hour claims, alongside failure to pay overtime.

Some insurance companies will provide a limited defense against these types of claims, but they are the rare exception. Even rarer are insurers who will actually pay the wages owed to employees if your ministry is found guilty.

To fully protect your ministry, it’s important to partner with an insurance specialist who fully understands the nuances of ministry. Even better if you partner with an insurance provider who has tailored insurance coverage to the unique needs of ministry.

Are you ready to partner with a ChurchWest agent for safer and effective ministry? Request a quote today to get started.

Charlie Cutler is the President of ChurchWest Insurance Services, a California-based agency that specializes in providing insurance solutions to churches and related ministries. Charlie has been with ChurchWest for over 25 years and has extensive experience in the insurance industry, with a particular focus on the unique risks and challenges facing Christian organizations. Charlie is a sought-after speaker and has presented at numerous conferences and seminars on insurance and risk management topics.

Sign up for the ChurchWest newsletter to stay up to date on all our latest content, webinars and event announcements.